Though many industrial sectors continued to improve in 2023, the metalworking industry faced challenges and instability, with the Institute of Supply Management (ISM) recording 12 straight months of contraction. In many sectors, worries loomed over weakening sales pipelines. But on the plus side, the slowdown alleviated some inflation pressures and shipping costs driven by lower input prices and declining container rates.

Much of the metalworking industry’s landscape was shaped by the disruption of the past few years, with some major lessons crystalizing by the end of Q4. Here’s what we learned from the frontlines in 2023:

1. Focus on What You Can Control Amid Uncertainty

Geopolitical conflicts, labor shortages, material price fluctuations, and other disruptions contribute to a collective sense of uncertainty around the industry. In times like these, the best strategy is to take action that can improve long-term stability and security.

Manufacturers should continue investing in nearshoring and reshoring to bring supply chains closer to home, reducing overreliance on distant and potentially unstable sources. Nearshoring and reshoring offer greater control over the production process, enabling quicker responses to disruptions and ensuring a consistent supply of critical components. More urgently, shortening supply chains reduces the sourcing risks associated with geopolitical tensions or trade disputes.

Another increasingly important investment is digital transformation and the Industrial Internet of Things (IIoT). IIoT offers real-time data monitoring and analysis capabilities, allowing manufacturers to quickly detect vulnerabilities in their operations, mitigating risks associated with supply chain disruptions. Predictive maintenance capabilities also reduce unexpected downtime and associated costs, giving manufacturers more resources to rely on during downturns.

2. Overcoming the Skills Gap Is Crucial for Growth

In 2023, the skills gap poses a significant obstacle to the growth of the manufacturing industry, restricting the capacity to innovate, adopt advanced technologies, and meet the rising demand precisely when all of these abilities are needed. The lack of a skilled workforce also hampers the industry’s capacity to embrace automation and digital transformation, hindering its competitiveness on a global scale. In fact, current projections show there could be over 2.1 million unfilled manufacturing jobs by 2030. Manufacturers must deepen investment in training and promote trades as rewarding career paths to attract more high-skilled workers.

3. It’s Time to Deepen Commitments to Sustainability

As stakeholders and consumers increasingly prioritize eco-friendly products, manufacturers who embrace sustainability increase their competitive edge in the market. Carbon emission reduction goals and sustainability impact reports are increasing. Manufacturers should consider deepening their commitment to hit their targets and maintain relevance as the market continues to favor sustainability. Fortunately, as the Harvard Business Review reported in September, government support for developing new green technologies has never been more significant, with legislation like the Inflation Reduction Act and the European Green Deal.

4. Prioritize Total Cost of Ownership for Long-term Strategy and Recovery

The pressures of inflation and uncertainty in the market make it easy to think short-term and prioritize low price supplies. However, it’s now abundantly clear that improving resilience requires a long-term view of the road ahead. Focusing on total cost of ownership (TCO) allows manufacturers to consider the full financial implications of a purchase, improving recovery, profitability, and even sustainability in the long run. Implementing TCO analysis as a standard operating procedure helps manufacturers optimize resource allocation, reduce unnecessary expenses, and make sustainable investments that set them on a path for long-term success.

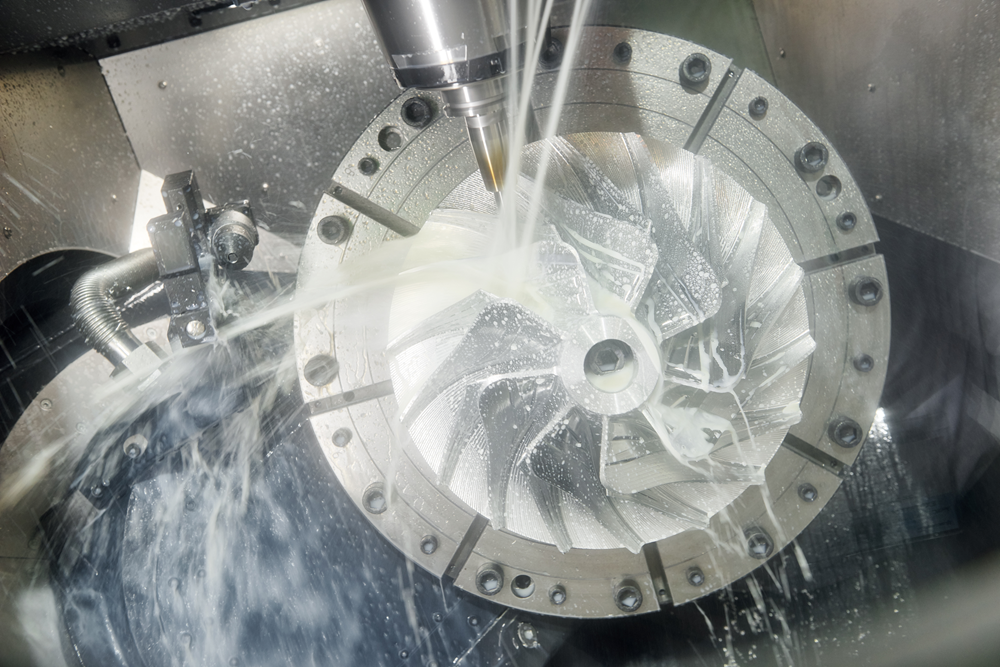

Partner With A Metalworking Industry Leader to Build Resilience

Building resilience remained a key trend in the manufacturing sector throughout 2023, and it will continue to dominate business strategy in 2024 and beyond. As we enter the new year, it’s more apparent than ever that establishing a secure and stable metalworking industry requires strong partnerships with trusted allies. Master Fluid Solutions was committed to helping customers weather the storm of the pandemic, and this dedication continues into the recovery era. Charging your sumps with our premiere TRIM® cutting fluids can be the first step in establishing long-term resilience. Request a free trial today.